When investment professionals and their firms fail to do their jobs properly, they—not their customers—should bear the consequences. The attorneys at ChapmanAlbin fight fiercely for victims of broker misconduct. Every client’s case becomes our cause. We do not guarantee outcomes, but we can and do guarantee that we will bring all the resources, expertise, and energy needed to put money back in our clients’ pockets. In recent months, we have helped our clients secure remarkable and historic awards against a major Wall Street financial services firm, including:

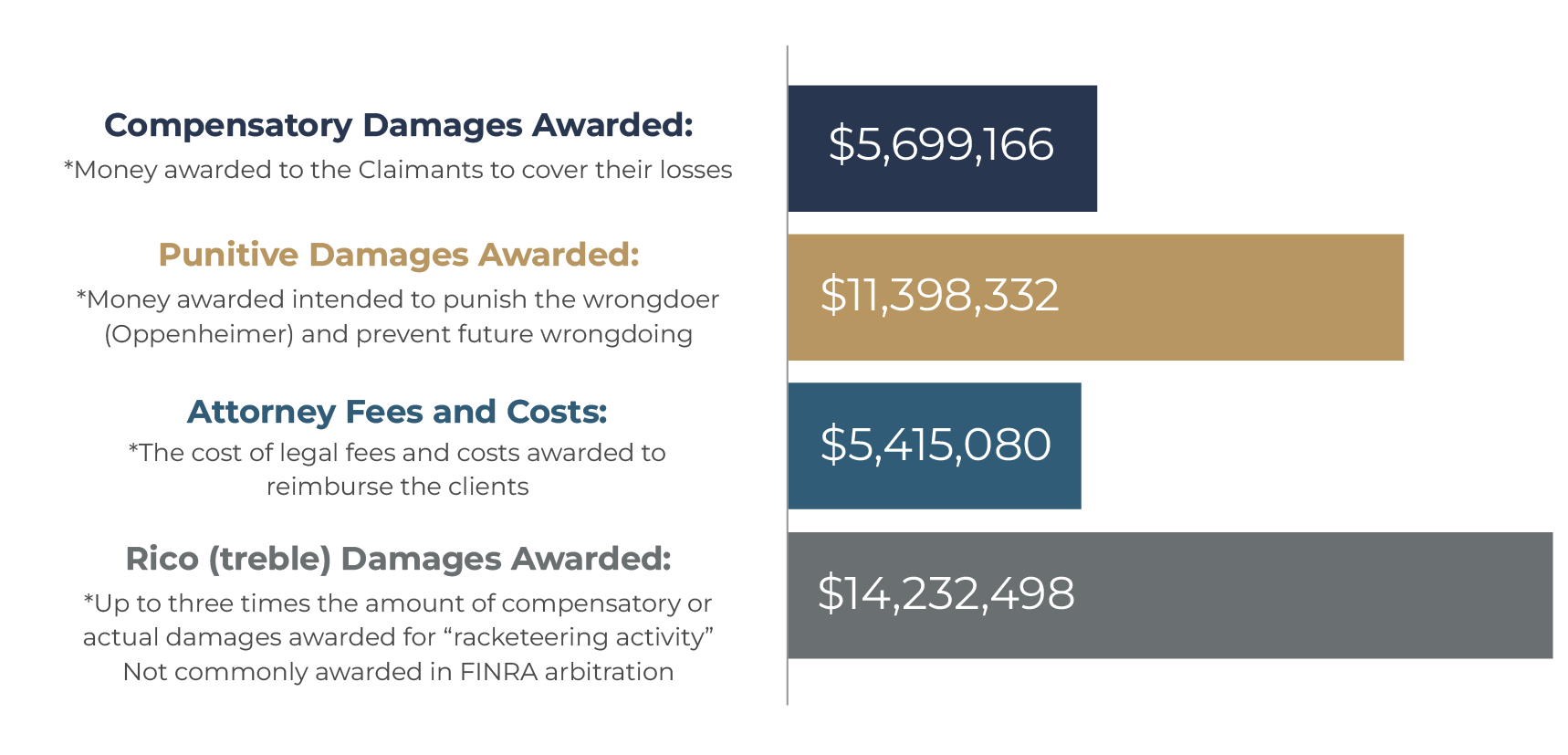

In a significant legal victory, ChapmanAlbin represented eleven investors affected by a Ponzi scheme tied to Oppenheimer & Co. The scheme involved fraudulent activities where investors were misled and had their funds misappropriated. The arbitrators ruled in favor of our clients, ordering Oppenheimer to pay $36.7 million in damages, which was 6.5 times our clients’ losses. The substantial award reflects the severity of the misconduct and the impact it had on our clients’ financial well-being.

For more details about this case, you can refer to this article.

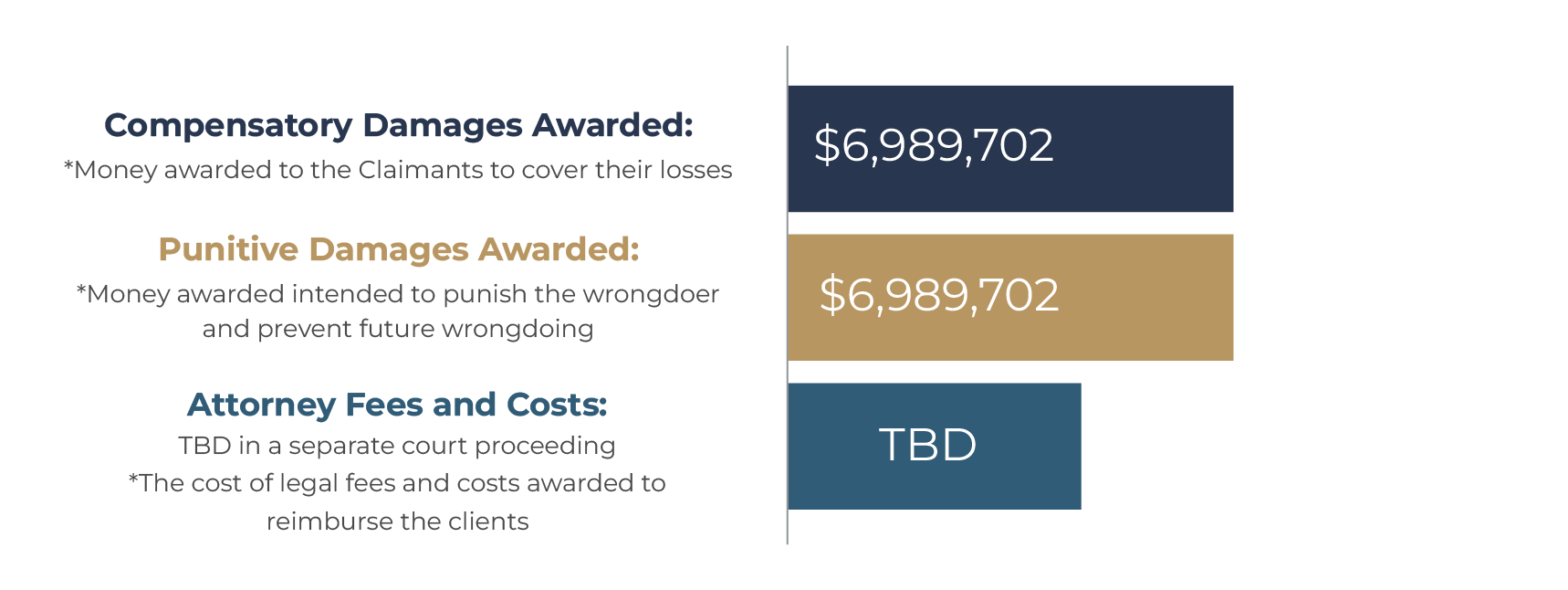

ChapmanAlbin achieved another significant win in the Horizon case representing another set of investors against Oppenheimer & Co. The case revolved around allegations of misconduct, including fraudulent practices and breach of fiduciary duty by Oppenheimer. The Financial Industry Regulatory Authority (FINRA) panel ordered Oppenheimer to pay $14 million in damages to our clients plus costs and attorney fees to be determined in a separate court proceeding. ChapmanAlbin’s diligent efforts and strong legal representation were instrumental in holding Oppenheimer accountable for their actions, providing our clients with the compensation they deserved.

For more information about the specifics of this case, please refer to this article.

Please note that the details provided are based on the articles linked for each case. For a comprehensive understanding, we encourage you to review the original articles, as they may contain additional information and context.

The ChapmanAlbin law firm has been fighting for investors for more than two decades. At ChapmanAlbin, we understand the complexities of investment disputes and the importance of safeguarding your financial well-being. We have the expertise and the resources to go toe-to-toe with the biggest players on Wall Street. With our track record of success in high-profile cases, you can trust us to fight vigorously on your behalf. Contact our experienced team today to discuss your investment-related concerns and explore your legal options.

*Disclaimer: The information provided on this website is for informational purposes only and does not constitute legal advice or establish an attorney-client relationship. Past results do not guarantee future outcomes. Please consult with a qualified attorney to assess your specific situation.*

Step 1.

Talk to an Experienced Attorney Today

Call and speak to one of our attorneys* for a no-cost consultation to discuss your situation, answer your questions, and help you determine the next steps. This call usually takes about 15 minutes, but we are happy to talk to you as long as you would like!

Step 2.

Quick Review of Your Paperwork

If we think you might have a case, we will need to review a few basic documents. If we determine you have a case, then you will have the option to hire us as your attorneys to pursue it.

Step 3.

Signed Attorney/Client Agreement

If you decide to hire us to pursue your case, we will have you sign an attorney-client agreement so we can begin the process of trying to recover your losses.*

*In the vast majority of cases, our agreement is contingent – meaning you won’t owe us any money unless we recover money for you.